Can I Roll Closing Costs Into Fha Streamline Refinance

FHA Streamline Refinance

An FHA streamline refinance is a great way to refinance an existing FHA loan with less paperwork and without the need for an appraisal or income documentation. Qualifying for an FHA streamline refinance is easy provided you meet a few simple requirements.

Refinancing your FHA home loan will provide you with an opportunity to lower your interest rate as well as your monthly mortgage payments. We will take you through all the features and benefits of an FHA streamline refinance and what is needed to qualify.

If you are ready to learn more and possibly get a rate quote, then click here to get connected to an FHA lender who can answer your questions and provide you with a rate quote.

5 FHA Streamline Refinance Requirements

These are the basic requirements of an FHA streamline refinance:

1. Your Current Mortgage Must Be an FHA Insured Loan

Only existing FHA mortgages can be refinanced with an FHA streamline refinance loan. If you have a mortgage that is not an FHA loan, then you can refinance to an FHA loan, but it cannot be an FHA streamline refinance. You would need to go through the full FHA application process with all of the required documentation and appraisal.

2. There Must Be a Net Tangible Benefit

The FHA guidelines define the net tangible benefit as a reduction in the interest rate, a reduction in the mortgage payment, or a positive change in the terms. If there is no significant savings for the borrower, then there is a chance the loan will not be approved. You may also increase the term from a 15yr loan to a 30yr loan if it helps to reduce your monthly payments. Changing from an adjustable rate to a fixed rate is also considered to be a benefit even if the payment increases.

3. The Existing FHA Loan Must Be Current

The existing FHA loan cannot have any late mortgage payments over the past three months. You may have one 30-day late payment over the past 12 months but your loan must not be past due at the time you are applying for a streamline refinance. You cannot refinance your FHA loan until you have made a minimum of 6 payments and 210 days have passed since the day of your closing.

4. You Cannot Increase Your Loan Amount to Cover Closing Costs

With an FHA streamline refinance, you cannot roll the closing costs into the loan. If you do not have the additional money for closing costs, the lender can pay for your closing costs. However, that will likely be offset by a higher rate.

5. Cash Out Refinances Are Not Permitted

You may not cash out equity with an FHA streamline refinance. The purpose of this loan is to lower your payments or the interest rate. The most you can walk away with at closing is $500 and that is likely due to any differences in closing costs.

FHA Streamline Refinance Benefits

These are some of the great benefits of an FHA streamline refinance:

- No appraisal required

- No income documentation needed

- No debt to income calculation

- Home can never be underwater (loan amount greater than home value)

- Faster loan approvals and closings

- Lower rates than conventional loans.

It is for these reasons why FHA streamline refinances have become so popular.

How Much Can You Borrow with an FHA Streamline Refinance?

You are not permitted to cash out equity with a streamline refinance and we know you cannot borrow enough to cover ALL of the closing costs. However, here is what you are permitted to borrow:

Your current principal balance

PLUS – One month's worth of prepaid interest

PLUS – The new net upfront mortgage insurance fee (minus any insurance refund from your current loan)

This is when you really need to think about the true net tangible benefit of refinancing. It won't make sense to do it unless you can see a lower payment amount. If you see that interest rates have dropped since you purchased your home, then you may want to consider an FHA streamline refinance.

FHA Streamline Credit Score Requirements

The minimum credit score requirements for an FHA streamline refinance is 500. This is the same as what you would find if you were purchasing the home. Not all lenders want to originate loans for individuals with scores that low and you do have lower credit scores, you may have difficulty refinancing. The lenders in our network all allow for credit scores down to 500.

Mortgage Insurance Premium and Refund For a Streamline Refinance

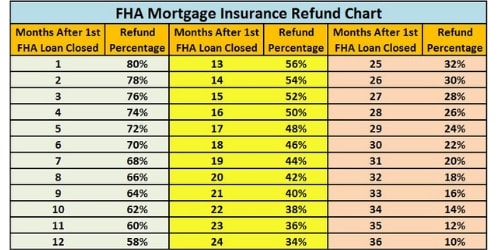

If you already paid an upfront mortgage insurance premium on your existing FHA loan, then you will be wondering why you need to pay for it again. It is true that you do have to pay for it once again for your refinance. However, you will get a pro-rated refund of what you paid initially. As a result, your new upfront mortgage insurance premium should be a lot lower than what you paid last time.

The FHA mortgage insurance premium refund is calculated on a pro-rated basis based upon how long you had your current FHA mortgage. The chart below shows you what you can expect in a refund at closing for what you originally paid in the upfront mortgage insurance premium.

For example, if your current mortgage is only 6 months old, you should expect to see a 70% refund in what you paid the first time.

Click to read more about FHA mortgage insurance premiums

FHA Streamline Refinance Closing Costs

When you refinance using an FHA streamline loan, you will see some of the standard FHA closing costs that you dealt with when you purchased the home. There are a few exceptions though. The largest expenses are referenced below and likely will not be included in your FHA streamline refinance:

- No appraisal fee

- Mortgage insurance refunded amount

- Prepaid interest can be rolled into the loan amount

With these big ticket items essentially removed from your out of pocket closing costs, your cash needed at closing will be significantly less. Read our article about FHA closing costs so you can get an understanding as to what you can expect.

FHA Streamline Refinance Rates

One of the many benefits of an FHA loan is the fact that the rates are usually better than conventional mortgages. The same applies for FHA streamline refinance rates. You can expect the rates to be similar to the rates offered for FHA purchase loans.

When your lender determines your FHA streamline refinance rate, they will take various factors into consideration. The most important factor is your credit score. The higher the FICO score, the better your rate will be. Keep in mind that once your score exceeds 720, there is no more benefit from a mortgage rate perspective. A score of 720 is essentially the same as a score of 800 when determining your rate.

If you are asking for your lender to cover the closing costs, then you should expect the rate to be slightly higher. It is a good idea to get a quote from one of our lenders where you pay for the closing costs, and one where they pay those costs. Then, you can see the payment difference and determine which is best for you long term

Click here to check on today's FHA streamline refinance rates

Documents Needed for an FHA Streamline Refinance

The following documents are what every lender will ask you to provide:

- Your current FHA mortgage statement

- The current mortgage note showing the details of your loan

- The settlement HUD-1 documentation from your current loan

- Two months bank statements showing that you have enough money to settle at closing

- Contact information for your employer so the lender can verify your employment

- Copy of your homeowner's insurance documentation proving you are insured

Summary

If the interest rate on your current FHA loan is higher than the current market rates, then you should really consider an FHA streamline refinance. Click to connect find an FHA lender in our network and they can review your options, provide a free rate quote, and help you to decide whether an FHA streamline refinance is right for you.

Related questions

When you would not want to refinance with an FHA loan?

One reason why you may not want to go for an FHA streamline refinance is if your current loan balance is less than 80% of the home value. If that is the case, then you may want to consider refinancing into a conventional loan. That way, you would save quite a bit in mortgage insurance premiums. Our lenders can also help you with conventional loans.

Can I get an FHA streamline refinance if I don't have an FHA loan now?

FHA streamline refinances are only available to individuals who currently have an FHA loan. If your existing mortgage is not an FHA loan, then you can refinance with an FHA insured mortgage but not a streamline FHA mortgage. You would need to provide all of the normal documentation, get an appraisal, etc

Can FHA streamline refinance closing costs be rolled into the loan?

Only one month's interest, and the upfront mortgage insurance premium can be included in the loan amount. The good news is your closing costs should be lower anyway. For example, you will not have the cost of an appraisal.

Is there a no cost FHA streamline refinance lender?

There are lenders who will work with you to make sure you have no out of pocket costs with your FHA streamline refinance. However, they will likely charge you a higher rate in exchange for that. We can help you to find a lender who can provide you with a no cost streamline refinance.

Can I get an FHA streamline refinance if the home is worth less than when I purchased it?

You can refinance an FHA loan even if the home is worth less or under water.

Is an FHA streamline refinance loan worth it?

If your monthly payment and interest rate is being reduced significantly, then an FHA streamline refinance is worth it. You should weigh the benefits and do the math before agreeing to any loan.

Related Articles

FHA Loan Requirements

Can I Get an FHA Loan for a Second Home?

How to Get an FHA Loan With No Out of Pocket Funds

HUD Guidelines on FHA Streamline Refinances

Can I Roll Closing Costs Into Fha Streamline Refinance

Source: https://fhalenders.com/fha-streamline-refinance/

0 Response to "Can I Roll Closing Costs Into Fha Streamline Refinance"

Post a Comment