Guided Reading 3 2 Business Growth and Expansion

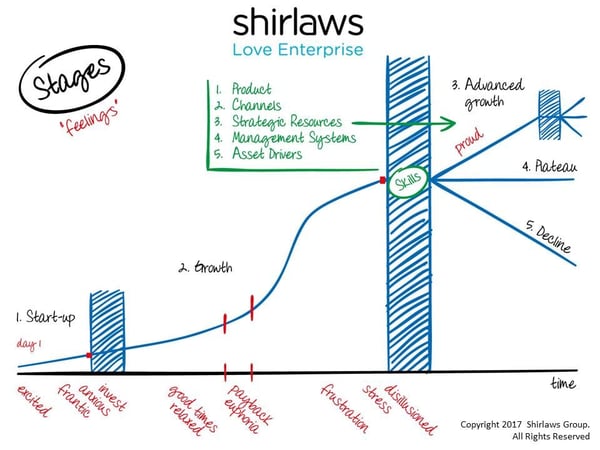

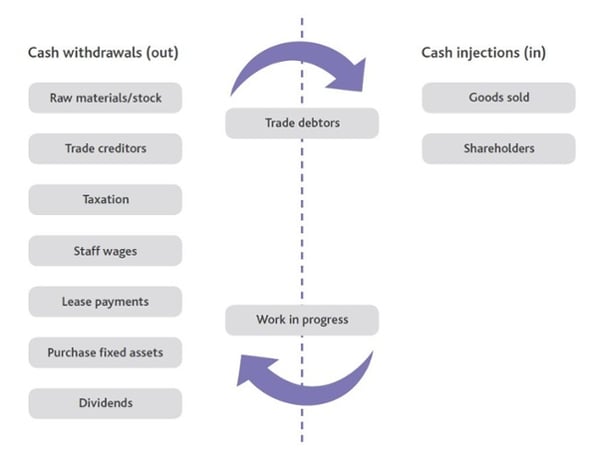

Following the frantic period of creating a business and having established a viable operation, you'll likely shift into a phase of growing sales, income and becoming profitable. This is reflected in the diagram below known as the Stages Model (a concept originally developed byShirlaws). Understanding which business life cycle stage you're at and the likely feelings you'll experience means you'll be better equipped for the emotional demands that come with running an expanding enterprise. The growth phase will initially feel like 'good times' as you reward yourself and enjoy 'payback' from the business in its move towards 'fast growth'. However, maintaining the rate of expansion, servicing customers and fulfilling financial commitments will create time constraints which can result in frustration and stress. Thankfully help is at hand. We've guided many expanding operations into the next phase of development, by obtaining the necessary systems, personnel and finance so that you can enjoy the rewards as your hard work begins to pay off. In the start-up What was functional for the past may no longer work today. You may now be operating out of an inappropriate structure and this can have consequences in terms of the amount of tax you pay, your degree of exposure to risk, filing and administrative requirements and your ability to access finance. Ultimately you should review your structure because changing it may help you develop and enhance the way you run your business. This Entering the growth phase will require a change in mindset from you as the business owner. When starting out your focus is on product/service development and market fit. However, with your business proven to work, you'll need to concentrate on 3 areas of strategic direction . You'll have probably taken on employees meaning they will be doing some of the work and servicing customer's needs. So now you'll need to develop a clear strategy to scale up in a sustainable manner. What A huge part of Finally, keep a firm hold on these two financial areas. Your margins will determine if you should alter prices or look to reduce costs. Review your cash position regularly to help you manage investment decisions and payments. This means undertaking cashflow forecasts to anticipate your working capital requirements not just today, but in the future as well. A large part of managing your cash position is by ensuring you have the necessary credit control systems in place to help improve your chances of being paid on time. Whilst there are few certainties in business, you can at least plan and reduce risk. In that You should design and implement a system to: Overdue debts are an acute problem for SMEs. If you're owed money then you might not have enough cash on deposit to settle bills or even pay employees. It also potentially delays or prevents you from investing in the business to fund expansion. Many good businesses go into receivership because they run out of cash. Often that's a result of either an inefficient credit control system, or, not having one at all! With growth comes more sales and invoices which means running your back office finance function will likely become more sophisticated. Unsure if this applies to you? There are 5 Taking on more employees will mean your UK payroll will become harder to administer. The reason being the rules and regulations with regards to payroll are quite complex. Just the process of administering and claiming statutory maternity pay or, offering an employer childcare voucher sheme , can be intricate and time consuming. For that reason outsourcing to a full service payroll bureau is likely to be preferable. Consider the following: Once you take on employees you'll need to notify HMRC that you're an employer. This is for Pay As You Earn (PAYE) purposes and will likely also require you to purchase software to run your payroll. Each of your employees will have a tax code that allocates their earnings into a particular bracket. It's absolutely vital to check that your staff Part of your payroll responsibilities will include paying NI contributions on your employees income and benefits. It's also your task as the employer to collect your employees' income tax deductions and class 1 NI contributions. RTI requires that you submit a PAYE statement every time your employees are paid in a pay period. This ensures HMRC As an employer, you have an obligation to Your management accounts will be a key element in understanding how well your business is doing on a regular basis. Whilst not mandatory they're vital to providing you with intelligence to make better informed strategic and investment decisions. The question then is what should they contain, what do you need them to report on? It's a difficult question because the answer will likely depend on the industry or sector you operate in and furthermore, no-one will know your business as well as you. So, there isn't necessarily a right or wrong way of going about reporting. That said, typically they will contain specific financial information that is compared to: Growing your business will require a significant amount of time, effort and investment. What you may not Research and development The patent box works whereby income generated from a patented product, or if the product contains a patented part, is identified and a reduced rate of corporation tax at 10% is applied to the profits associated with it. Determining the income associated with a patent can be very complicated and requires good accounting systems and controls in place to do so accurately. The Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) are tax schemes designed around funding for With growth will come greater competition, not just Many businesses will work through the early start-up stages on finite resources. The growth phase The key is to prepare for this by understanding the different financing options available be it short term or long term funding. For example you may be looking to take on investors as their funding may come with mentoring and a book of useful contacts. The consideration might then be between angel investors or Venture Capital funding depending on your size and circumstances. By working closely with an accountant you trust, you'll be able to decipher which finance options are relevant to your needs and how much funding you're going to need. You may even then be able to make use of their network of contacts for introductions to the right sources of finance. The Wellers approach epitomises the phrase 'there are no problems, only solutions'. The service is super responsive and the advice always highly commercial. Wellers provide focused commercial intelligence that I have yet to come across in any other firm working with SMEs. They are always willing to go the extra yard. James Uffindell, CEO & Founder of Bright NetworkFinancial management to help unlock business growth

Advising owners on expansion into the next phase of development and profitability.

1. Why you should review the different types of ownership structures

2. Where to focus? Strategies for achieving and sustaining growth

3. The credit control items required to improve cash flow

4. Can your online accounting software keep up with your growth?

5. Why you will need a full service payroll

Setting up the payroll

Applying tax codes

National insurance (NI)

6. What you need from your management accounts

7. The different areas of business tax relief to explore

R&D tax

The patent box

SEIS & EIS

Enterprise Management Incentives

8. Financing business expansion

Please note that the names and characters used in the examples mentioned above are hypothetical. Please also be aware that information provided on this page is subject to regular legal and regulatory change. We recommend that you do not take any information held

Testimonial

Guided Reading 3 2 Business Growth and Expansion

Source: https://www.wellersaccountants.co.uk/pages/financial-management-to-help-unlock-business-growth

0 Response to "Guided Reading 3 2 Business Growth and Expansion"

Post a Comment